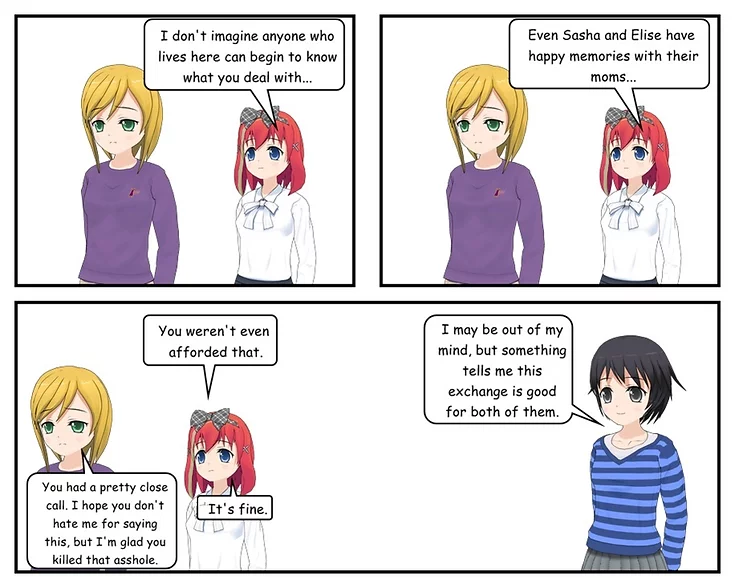

Illustrated Series #74

Previous... ...Next

Previous... ...Next

Don’t fall for this scam – High Yield Investment Programs (HYIPs) – they’re usually a Ponzi scheme

High-Yield Investment Programs (HYIPs) are often associated with Ponzi schemes due to their similar characteristics and deceptive practices. HYIPs promise investors exceptionally high returns on their investments in a short period, which lures people with the allure of quick and substantial profits. However, in reality, High Yield Investment Programs operate on unsustainable business models that rely on continuously attracting new investors to pay returns to earlier investors. This structure resembles a classic Ponzi scheme, where the funds from new investors are used to pay fake returns to previous investors, creating an illusion of profitability.

Firstly, High Yield Investment Programs often lack legitimate sources of revenue or sustainable business strategies to generate the promised returns. Instead, they rely solely on the influx of new investments to stay afloat, creating a cycle of dependency on new participants. This lack of genuine revenue streams means that the returns are not generated from actual profits but rather from the investments of subsequent participants.

Secondly, High Yield Investment Programs frequently use complex referral and commission systems to encourage existing investors to recruit new members. The more referrals they bring in, the higher their promised returns. This tactic amplifies the Ponzi scheme's growth, as participants are incentivized to recruit others into the program, keeping the cycle going until it inevitably collapses.

Thirdly, HYIPs often display characteristics of secrecy and lack of transparency about their operations. They provide vague or misleading information about their investment strategies, making it difficult for investors to understand how their funds are being utilized. This opacity serves to hide the fraudulent nature of the scheme and prevent investors from realizing the truth until it's too late.

Lastly, like Ponzi schemes, High Yield Investment Programs collapse when there is an insufficient number of new investors to sustain the payouts to earlier investors. When the scheme can no longer attract enough fresh funds, it crumbles, leaving the majority of investors with substantial losses and only benefiting a few at the top who profited earlier. The deceptive nature of HYIPs makes them risky and dangerous investment vehicles, and investors should exercise extreme caution and conduct thorough research before considering any involvement with such programs.

Typically, if something sounds too good to be true, like most High Yield Investment Programs (HYIPs) do, it probably is.

Nobody's Property illustrated series is published on nobodysproperty.com by Blake Hutchison dba Sansevieria Media. All rights reserved.

© Nobody's Property Illustrated Series, copyright 2018- | all rights reserved. This illustrated series is for entertainment purposes only. Please do not attempt any homicidal, vigilante, or other illegal acts.